McKinney School System - Location, Location, Location

There is no shortage of places to get a home loan from and there are plenty of qualified professionals who work hard in the lending world. Picking a lender is an important piece to the real estate puzzle, so how do you choose one? A good lender will help you avoid the issues that can cause delayed closings, sudden changes to terms of the loan and keep you from laying in bed with a massive headache worrying about how you’re going to buy your home. The best lender is the lender you know and trust.

When choosing a lender, there are a few things you should consider. You want someone you feel comfortable around, you want someone who knows the business and the loan products available, but most importantly, you want someone you can meet face to face.

Without that face to face connection, loans can become frustrating to the point of banging your head against a wall. This is why most real estate agents will advise against internet-based lenders. Although some of them may offer slightly better rates, if the loan doesn’t close, you’re still left without a home and that better interest rate means nothing.

Ask your agent who their clients are using and who is getting the job done. Ask your friends and family – but don’t ask your uncle who bought a house once in 1963 that isn’t in the same state as your new home. Local is the best way to go.

Once you find a lender that rocks – let others know, pass their name on. Just like real estate agents, lenders rely on word of mouth and referrals to build their business. Knowing your lender face to face can make a huge difference in the home buying process, so interview a few and find that perfect match.

When you are ready to begin searching for a new home, the process can seem overwhelming. Not only do you have to take a look at the homes themselves, but you have contract negotiations, inspections, financing and more. That’s why it’s important to have a professional REALTOR® on your side to guide you through the process and help look out for your best interests along the way.

A typical transaction roadmap involves the following steps:

Loan Pre-Qualification -> Home Search -> Write an Offer -> Negotiate a Contract -> Property Inspections -> Secure Financing -> Closing

While each transaction can be different, these critical elements form the backbone of most real estate purchases in Texas.

One of the largest pieces to the home buying puzzle is financing. While some people prefer to pay cash for their homes, a large majority take out a mortgage in order to buy property. Getting pre-qualified with a knowledgeable lender can help you to understand:

Once you have a good grasp of your financing options, your lender can provide you with a letter stating your pre-approval status. If you are looking to purchase a home by paying cash, your financial institution can issue a similar letter verifying funds.

Many sellers in today’s market require evidence of financial viability before even reviewing any offers. With that in hand, then you can move on to finding the right home.

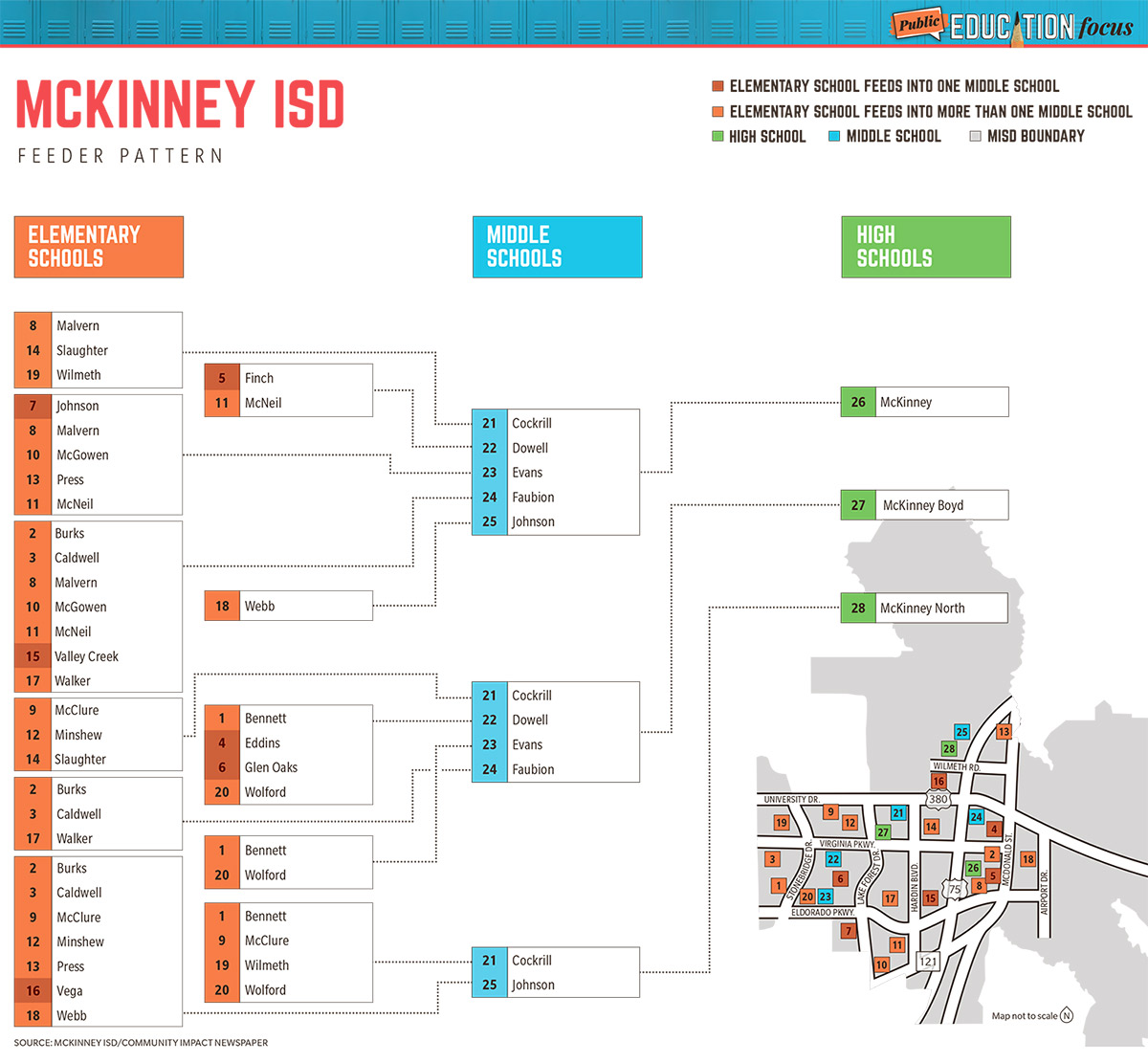

One of the most helpful things you can do as a consumer is to come up with a list of priorities in your home search. If there’s a neighborhood or school district you have to be in, that can help you to narrow in on the right home much more quickly. If you have special needs (such as wanting to keep sheep) or extreme flexibility in your living space, it’s important to communicate these issues to your agent up front. That way they can work with you to narrow down your criteria and implement a comprehensive search of available homes.

Many people take up the home search themselves through the internet. This can be extremely informative, but also misleading, as many websites contain outdated or inaccurate information. Kimberly Howell Properties agents have access to thousands of the most up-to-date listings in and around San Antonio. This includes Boerne, New Braunfels, Pleasanton and even Seguin. They are specially trained to help you sort through your criteria, examine neighborhood features and show you available homes that meet both your wants and your needs. Even if a property is not listed on the local MLS, your agent can make arrangements to show you the property.

Your agent can then schedule times for you to tour your property choices, and help you keep track of your likes and dislikes for each home or area. If your criteria changes, your agent can adjust your search accordingly.

Once you have found the home of your dreams, your agent will continue to research the market and help you to formulate and negotiate an offer. They can explain the terms of the contract to you, and help you put together an offer that is strong but also meets your specific needs. The offer will address a sales price, but will also cover issues of closing date, home warranty, repairs, title policy and more, and your agent can explain the who, what and why’s of each element. The agent will give you advice and information, but at the end of the day, it is your decision as to what price and terms you offer. REALTORs® are required to use specific state regulated contract documents. You are always advised to have an attorney of your choice review any offers or contracts if you so choose.

Once an offer is submitted, you wait for a response from the seller. Possible responses include:

It is important to note that contracts are not legally binding in Texas until signed by all parties. Many times offers are negotiated verbally for ease and expediency; however, until all parties (buyer and seller) have signed off on all terms, the contract is not enforceable.

In the case of multiple offers, there are very specific procedures that should be followed by the seller. Ultimately a decision as to which offer is accepted or countered lies in the hands of the seller alone, and even a full price offer may not be selected. A seller working with an agent should be advised to treat all parties fairly and no single offer should be given an unfair advantage over another. Your agent’s experience, education and professionalism can help you to navigate these tricky waters should you find yourself in this type of offer situation.

When the negotiating ends and everyone has signed off on the paperwork, you’re officially under contract. Earnest money will be kept in escrow with the title company, a neutral third party.

There will be several critical elements that you and your agent can work together to address and complete as you move the process towards closing.

Once all of the above pieces come together, and the lender sends closing instructions to the title company for your loan, transfer of title, etc. you can arrange a time to close on the home. The title company will provide a breakdown of credits and expenses for both buyer and seller, called a HUD-1. You will generally go to a title company office to sign all closing paperwork and loan documents. You will deposit the balance of your down payment and closing costs to escrow, and your lender will deposit the balance of the purchase price. The deal is not closed until monies have been paid. This is often referred to as “funding.”

Once the property funds, you can pick up the keys and move into your new home! Your agent can help you make the necessary arrangements for moving, utilities and more.

You may need to think about repair amendments during the course of buying a home, typically during the option period and after your inspection. Your agent will prepare your repair amendments for you, but as a buyer, it pays to understand how to write an effective repair amendment as the language used in them can have serious effects down the road. Understanding both how to write a repair amendment with negotiations and the final outcome in mind, as well as how to write them so that what you want is really what you get, can save you a lot of time and hassle later down the road. Remember, these repair amendments become part of the contract and performance of the items contained within them is serious business. Many real estate lawsuits center around the repairs agreed to and made and whether or not they were sufficient. Know what goes into the repair amendment before you sign so you can avoid any issues that could affect your purchase.

After your inspection and your review of the inspection report, you’ll probably have a laundry list of items that you want to be repaired in order for you to continue with the purchase of this home. We understand anyone’s desire to have everything perfect in their new home, but the reality is that all homes have items that can or should be fixed. Even the inspection on a brand new home will turn up items that need correcting. The goal here is to come up with a list of items that the seller needs to fix…and that they will agree to.

Since no home is ever perfect, you’re going to need to take a look at the inspection report and decide what matters to you most and what can be negotiated by both parties to create the magical win-win situation. Simply sending over an inspection report and saying “fix everything” will more than likely get you a denial from the seller. So how do you determine what to ask for and what not to ask for?

You want to take a look at the big picture. What items do you feel are the so-called “deal killers” – those items that you cannot see past and will cause you to walk away from the home in an instant. Typically, we see these are big-ticket items like roofs and HVAC units or health and safety issues such as faulty wiring or items that create a risk of fire, electrocution or explosion (think leaking gas).

Every homebuyer is different though and what you might consider a no-go, the next homebuyer might not even flinch at. It all depends on your needs and comfort level.

As well as your needs, you’ll need to consider where the seller is coming from. Did they just take a really low offer from you on the home? Are they trying to move quickly due to a relocation? Are they facing foreclosure or perhaps they just need to sell because they don’t have the money? There are so many factors to consider and your real estate agent can help you see some of the potential pitfalls to the negotiation before they even happen. Remember, the goal is to get the seller to repair items, not bury them in so much that they refuse to do anything.

Our biggest tips to writing repair amendments are simple: be specific, don’t overuse words and don’t under explain what you need, and let the inspection report do the talking.

Be specific. We’ve seen cases where repair amendments said something along the lines of “have sprinkler system checked.” The seller did exactly that. They paid to have someone come out and inspect the sprinkler system…and nothing more. There were issues with the sprinkler system (in this particular case a broken pipe under a sidewalk which was causing a major loss of water) and because of the language in the inspection report, the seller merely confirmed what everyone already knew, the sprinkler system needed repair. The two strongest words you can use in a repair amendment are repair and replace.

Over/under explaining things. Be succinct in your wording. Don’t become a junior inspector or plumber or electrician. Let the experts determine what is wrong and fix it. Sometimes people try to use a lot of big words or even legalese to make the repair amendment sound official. You want to write clearly and in simple, plain language to get to the heart of what it is you want to be accomplished.

Let the inspection report do the talking. Quote items in the inspection report and give reference numbers for pages or sections of the report where the item appears. Let the inspector’s words inform what needs to be done.

Remember, that all repairs must be done by a licensed person if the trade requires a license (plumbing and electrical are two examples) or by someone regularly employed in a trade that reflects what they are doing. In other words, if you hire a handyman to fix items on a repair amendment, they need to be a handyman as their regular job, not just Uncle Bob who says he can fix it. These two requirements can be overruled if agreed to by both parties and put into writing.

The more precise you are with repair amendments, the better your results will be. Remember to think items through as well, what are the consequences of the action you’re requesting? We see a lot of arguments over removing items like TV brackets. If someone requests “remove TV brackets” on a repair amendment, they might get exactly that. What’s left when you remove TV brackets? Big holes and mismatched paint. You may want to use something more along the lines of “remove TV brackets and repair, patch, texture, and paint to match current walls” so that you have a more detailed explanation of what you want to be done. Remember, there is no “they should have known what I meant” clause in contracts.

What is a home appraisal? An appraisal is a written document by a Licensed Appraiser hired by the Lender that will give you the mortgage on your home.

The Appraiser’s responsibility is to make sure the home is worth what you are paying for it and the Lender is loaning on it. It might surprise you to know that your down payments may also be taken into consideration. The Appraisal is not necessarily the value of what the home is worth.

The major determining factor is based on sales in the neighborhood of similar homes in size, condition and style, for the previous six to twelve months. These figures are derived from the same MLS system that REALTORS® use.

If your home purchase is a non-qualifying assumption or a cash sale, an appraisal is not required and in most cases, one is not done.

However in highly competetive markets where multiple offers are the rule, and offers above list are common, the mortgage lenders appraisal policies can become a dominant factor in making a succesful offer. In such cases, it is not uncommon practice for a motivated buyer to offer to pay the differece between the offered price and appraiser's value.

Best McKinney Realtor, Closing, Title Company, Mortgage Lender

Here are some very practical tips on making an offer on a house. Whether you are buying or selling a home, consider the sale of a home as a transaction that is beneficial to both parties. It is true that an asking price is exactly that: An asking price. Very often buyers and sellers become emotional, feel slighted or even offended if neither party makes responsible and realistic offers

.

Mortgage lenders require their customers to get title insurance. The companies also require that you pay for a title search. A title search is an extensive search through legal documents to prove the person selling you the property has legal claim to do it. So why have title insurance in addition to a title search? The search may have an error, or it may have come across forged documents, which would pass the title search. Around six percent of all policies have a claim, so it is not as uncommon as some may think.